94% of 2026 Homebuyers Will Change Their Plans If Interest Rates Don't Drop

PR Newswire

ST. LOUIS, Mo., Feb. 5, 2026

With 59% of 2026 buyers saying mortgage rates matter more than home prices, nearly two-thirds (64%) would only accept a rate under 6% — an outcome experts don't expect.

ST. LOUIS, Mo., Feb. 5, 2026 /PRNewswire/ -- Despite expert forecasts that mortgage rates will remain relatively steady this year, 94% of Americans planning to buy a home in 2026 would change their plans if rates don't drop below 6%, according to a new report from Best Interest Financial and Clever Real Estate.

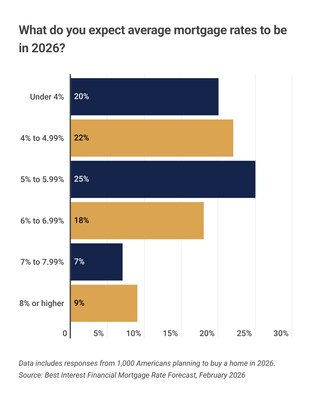

Fewer than half of buyers (43%) believe typical 2026 mortgage rates will land between 5% and 7% in 2026, the range most industry experts predict based on inflation, unemployment, and Treasury data.

"Unless the economy clearly breaks or inflation decisively rolls over, rates are more likely to hover in the low- to mid-6% range rather than fall meaningfully below it," said John Donikian, vice president at Best Interest Financial.

Still, 20% of buyers expect 2026's average rates to be sub-4%, despite the fact that rates haven't been that low since 2022, while just 16% expect an average of 7% or higher.

Overall, 61% of buyers expect a recession this year that they believe will impact rates.

If they applied today, two-thirds of buyers (66%) believe they'd personally receive a mortgage rate under 6%, including 43% who expect a rate under 5% and 25% who anticipate a Great Recession–era rate below 4%.

However, these expectations may be reflective of buyers' frustrations, with 67% feeling stressed about interest rates. High rates have already delayed plans for 64% of buyers, while 69% say it's reduced their confidence in the housing market.

Meanwhile, 58% say current rates make homeownership unattainable to them, and a third (33%) aren't confident they'd qualify for a mortgage today.

In fact, 38% say a 50-year mortgage with lower monthly payments would be the only way they could afford to buy.

When asked what's most to blame for high interest rates, Americans are split between inflation (29%) and the Trump administration and its policies (27%).

Read the full report at: https://bestinterest.com/research/mortgage-rate-forecast-2026/?utm_source=press_release&utm_medium=pr&utm_campaign=mortgage_forecast_2026

About Best Interest Financial

At Best Interest Financial, borrowers come first, with personalized guidance and tailored mortgage options. Since 2024, hundreds of families have trusted Best Interest Financial to achieve their dream of homeownership. Now an affiliate of Clever Real Estate, a free agent-matching service that's saved consumers $210 million on Realtor fees since 2017, Best Interest shares a mission to connect people with the best solutions for every step of their real estate journey.

About Clever

Clever Real Estate's content reaches over 10 million readers annually, and its nationwide agent matching service has a 5.0-star Trustpilot rating across 3,800+ customer reviews. Since launching in 2017, Clever has reached $15 billion in real estate sold, matched 194,000+ customers with realtors, and saved consumers over $220 million on commission fees. Clever's network spans 18,000 agents across all 50 states.

CONTACT:

Nicole Lehman

Clever Real Estate

408755@email4pr.com

724-719-0406

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/94-of-2026-homebuyers-will-change-their-plans-if-interest-rates-dont-drop-302680394.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/94-of-2026-homebuyers-will-change-their-plans-if-interest-rates-dont-drop-302680394.html

SOURCE Best Interest Financial